Publication | Spot Market Sales of Wind Energy After PPAs: What Captured Prices and New Strategies?

Historically, the development of renewable production capacities, particularly wind, has relied on public support mechanisms such as purchase tariffs and, more recently, compensation supplements. These mechanisms allowed renewable energy producers to secure their revenues by being partially or fully insulated from electricity market fluctuations. In this context, market price variations, however extreme, had only a limited impact on their revenues, and producers did not need to hedge through futures markets.

However, by 2025, an increasing share of the French wind farm park is now exposed to the dynamics of the electricity market.

Several factors explain this transition:

- The end of support for older facilities: Many wind turbines installed in the 2000s and subject to guaranteed purchase contracts of 15 to 20 years are gradually exiting these schemes. They must then sell their production directly on the electricity markets or through aggregators.

- The rise of PPAs (Power Purchase Agreements) and direct sales: New wind capacities are being developed based on long-term contracts with consumer companies (PPAs of 10 to 30 years) or through direct sales on the markets. This latter option implies a stronger exposure to prices, the visibility of which remains limited to a few years (maximum horizon of 5 years in France on wholesale markets).

- An evolution of support mechanisms: With the rise in material costs and the increased volatility of electricity prices observed since 2022, support mechanisms are becoming less attractive. Some producers now prefer to be exposed to market prices rather than opting for compensation supplements under conditions considered less favorable.

What is the market value of wind production?

Unlike purchase tariffs, which change relatively little and are defined by regulatory formulas or the results of tender processes (AO), electricity prices on the markets fluctuate constantly. Electricity is traded in blocks, that is, a fixed power over a given duration. However, the production of renewable energies, particularly wind, does not follow this rigid model. Wind power varies according to weather conditions, with notable differences between seasons and times of the day. This specificity leads to a difference between the average market price and the price actually perceived by a wind farm, a gap called the "capture price." This can be lower or, in certain market configurations, higher than the baseload price.

When an aggregator buys the production of a wind farm out of the purchase obligation at a fixed price for a given period, it must take into account the production profile, its hourly and seasonal variability, and market valuation opportunities. Thanks to market prices available for the future, brought to an hourly granularity, it can estimate the potential market value of the production and propose a price to the producer.

The captured price thus varies according to several factors:

- The type of energy: wind, solar, and run-of-river hydro have very different production profiles, which impacts their market valuation.

- The location and energy mix: in some regions or countries heavily equipped with renewable energies, an electricity surplus can reduce the capture price at certain hours.

- The evolution of market prices: the capture price of an installation is not fixed and can fluctuate significantly from one year to the next.

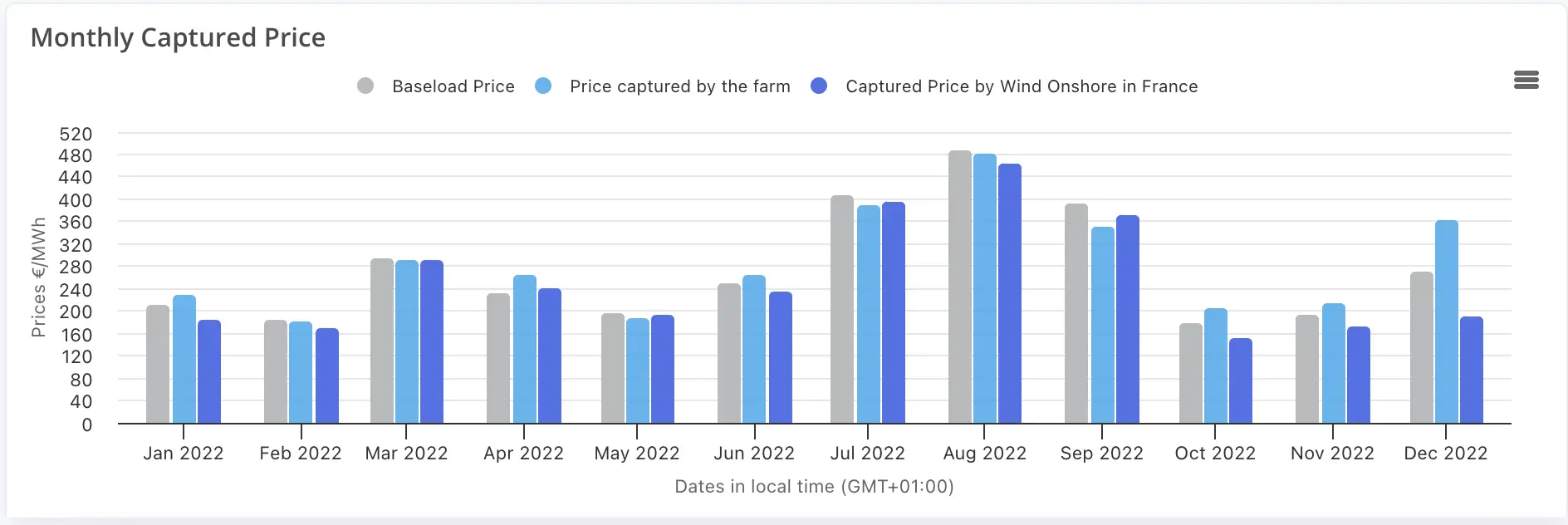

For example, if we estimate the theoretical market value of wind production in France:

- In 2022, the captured price of the overall onshore park was very high, reaching €234/MWh, due to tensions in the energy markets. Nevertheless, this captured price was still significantly lower than the average baseload price of the same year, which reached €276/MWh.

- In 2024, it was only €52.35/MWh, illustrating a sharp drop due to a normalization of the market and the growing impact of renewable production on price formation, against €55.09/MWh for the average baseload price.

However, if we observe the wind farms one by one, region by region, we surprisingly find that some parks, especially in the Rhône Valley, managed to capture an annual price close to €290/MWh in 2022 and exceeding €60/MWh in 2024, which is significantly more than the day-ahead spot price of the French market.

New challenges for wind producers

The increasing integration of wind parks into electricity spot markets thus raises new challenges for producers, both in terms of valorizing their production and managing the risks associated with price volatility.

Indeed, the intermittent nature of wind production requires a reevaluation of marketing strategies and price hedging, in order to optimize asset profitability while minimizing the negative impacts associated with market fluctuations.

Diversification of marketing modes

- The use of long-term contracts (PPA - Power Purchase Agreements) allows securing part of the revenues by setting a stable price over several years, thus reducing exposure to spot market volatility.

- Multi-market aggregation, combining futures and spot sales, optimizes valorization by capturing price opportunities over different maturities.

Improvement of flexibility management and strategic shutdowns

- The integration of production optimization tools allows adjusting the operation of wind turbines based on price signals, notably by reducing production during episodes of negative prices.

- Some producers are experimenting with partnerships with storage actors (stationary batteries or hydrogen) to defer electricity sales and maximize the capture of high prices.

Better anticipation of wind farm production and market prices

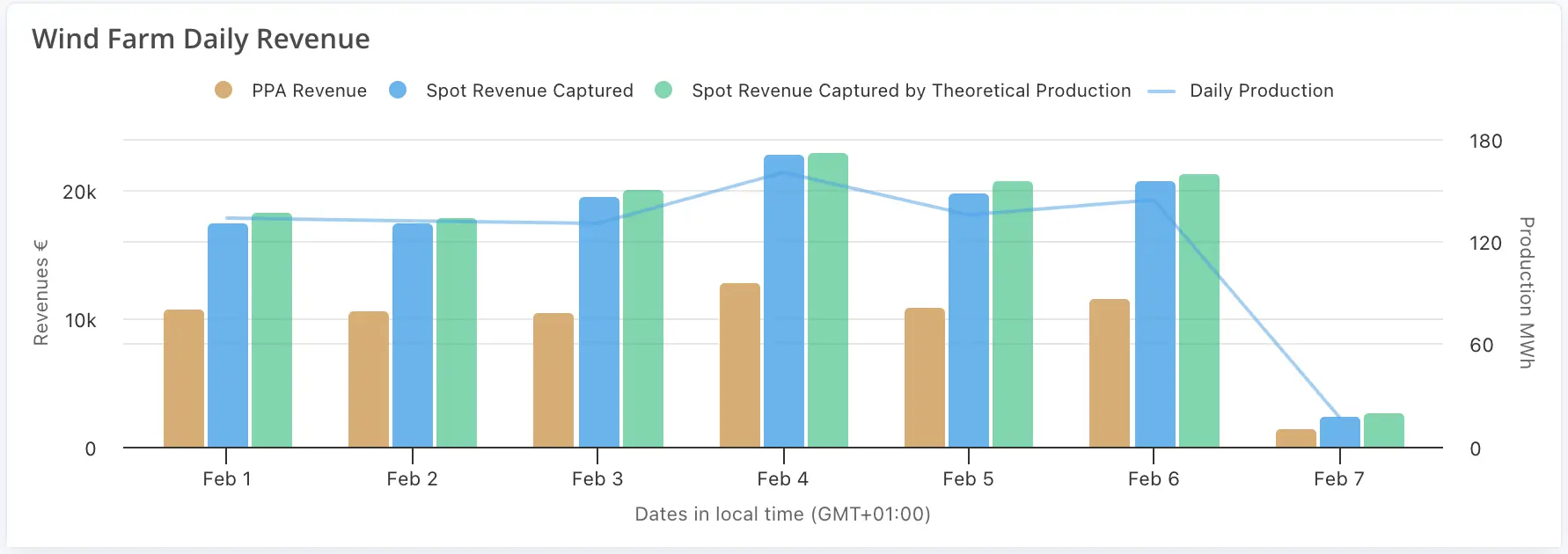

- Monthly analysis of the captured price by each park, combined with precise weather forecasts, allows adjusting the sales strategy in the short and medium term.

- In the shorter term, anticipation over several days may be relevant to adjust the marketing strategy on the day-ahead and intraday market, exploiting variations in price and production forecasts.

Conclusion

The gradual entry of wind producers into the free market represents a major transformation of their business model, requiring a reconfiguration of sales strategies and risk management. The analysis of the capture price and the implementation of marketing optimization strategies, or storage optimization associated with the production profile, appear essential to take advantage of the opportunities offered by the market, while mitigating the effects of volatility and price cannibalization.

Going further

With WindDeep, you can specifically track the captured value in the spot market of your wind farm and compare it, month by month, year by year, with the revenue generated from a PPA. You can also anticipate negative prices for the coming days and know the captured value at D+2, all from our application solutions in many countries in the world.

You can also request a diagnostic, in the form of an audit report, for a period of your choice, on the economic performance of your wind farm, its correlation with the spot market, and the captured value of all wind energy.

@2024 Winddeep. All rights reserved. Florie Mazzorana